PSM tells how taxing nation’s richest men can replenish lost GST revenue

Parti Sosialis Malaysia says taxing Malaysia's billionaires according to their wealth could bring the government RM20.52 billion in revenue.

Just In

Parti Sosialis Malaysia (PSM) has proposed that the government tax the country’s “super rich” instead of bringing back the goods and services tax (GST) as recently broached by Prime Minister Ismail Sabri Yaakob.

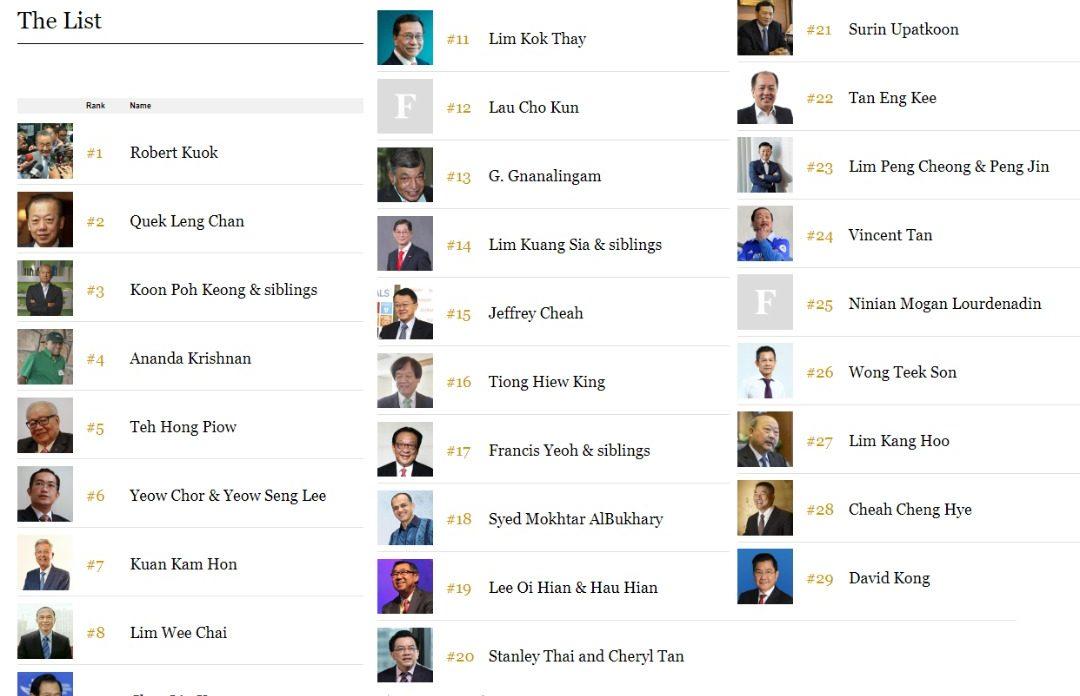

Outlining its proposal by listing a who’s who of Malaysian billionaires divided into five wealth brackets, the party said the government could rake in RM20.52 billion in revenue by taxing them between 2% and 10% of their assets.

“Wealth tax is a tax levied on the value of held assets,” it said.

“Tax on wealth of RM1 billion and above, starting from 2% and progressively increasing to 10%. This would be calculated proportionately according to the tax bracket in which they fall.”

It also included an estimated breakdown of tax revenue per billionaire in a list topped by Malaysia’s richest man, business magnate Robert Kuok, whose net worth as of 2022 was placed at US$11.1 billion or just under RM50 billion.

Ismail had said in an interview with Nikkei that the government was keen on reintroducing the tax despite its unpopularity.

He said Putrajaya had limited options, and that it had lost RM20 billion in annual revenue after the tax was abolished.

He also said that the government would target a GST rate that did not burden the people, but was not so low that it “defeats the purpose of expanding tax revenue”.

This sparked a strong response from opposition pact Pakatan Harapan (PH), which said yesterday that any move to this effect would cause a drastic spike in the price of goods.

It also said that the people were already struggling with the rising cost of living and declining household incomes amid high inflation.

Malaysia’s 6% GST was introduced in 2015 but scrapped three years later after PH, led by Dr Mahathir Mohamad, took over Putrajaya.

Subscribe to our newsletter

To be updated with all the latest news and analyses daily.

Most Read

No articles found.